READY TO GROW YOUR TAX BUSINESS?

BECOME A

SERVICE BUREAU

Learn how service bureau owners generate 6 figure incomes

without preparing a single tax return.

Transform Your Tax Business with the eMerge Tax Pro Service Bureau Program

Designed for experienced tax professionals like you who are ready to elevate their business to new heights. Partnering with us is more than just software, you'll learn

business operations, management and compliance

to separate yourself from the rest and boost your profitability.

What is a

Service Bureau?

The Secret to 6 & 7 Figures in the Tax Industry

A service bureau in the tax industry acts as a central hub that provides professional tax software branded under your own label, technical support, marketing services and professional guidance to independent tax preparers and tax firms.

Service bureaus make money through various revenue streams. As a tax professional, becoming a service bureau will expand your business by providing additional services such as software sales, technical support, customer service, and bank onboarding to other tax professionals. The fees associated with providing these services can help grow your business and generate revenue for your bottom line.

We Create Successful Service Bureaus:

Unlimited Software Licenses:

Sell as many software licenses as you want to have a successful tax season.

Integrated Bank Products

Fully integrated with the best banking partners in the industry offering refund products.

Dedicated Training

One-on-one training for software practices and preparation procedures. if needed.

Concierge Support

Sell as many software licenses as you want to have a successful tax season.

Detailed Reporting

Real-time analytics and reports for your sub-bureaus.

Product Partnerships

Providing other services & products within the marketplace to have a success tax season.

How Do Service Bureaus Gain Revenue?

Here's how our service bureau owners generate 6-figure incomes without preparing a single tax return

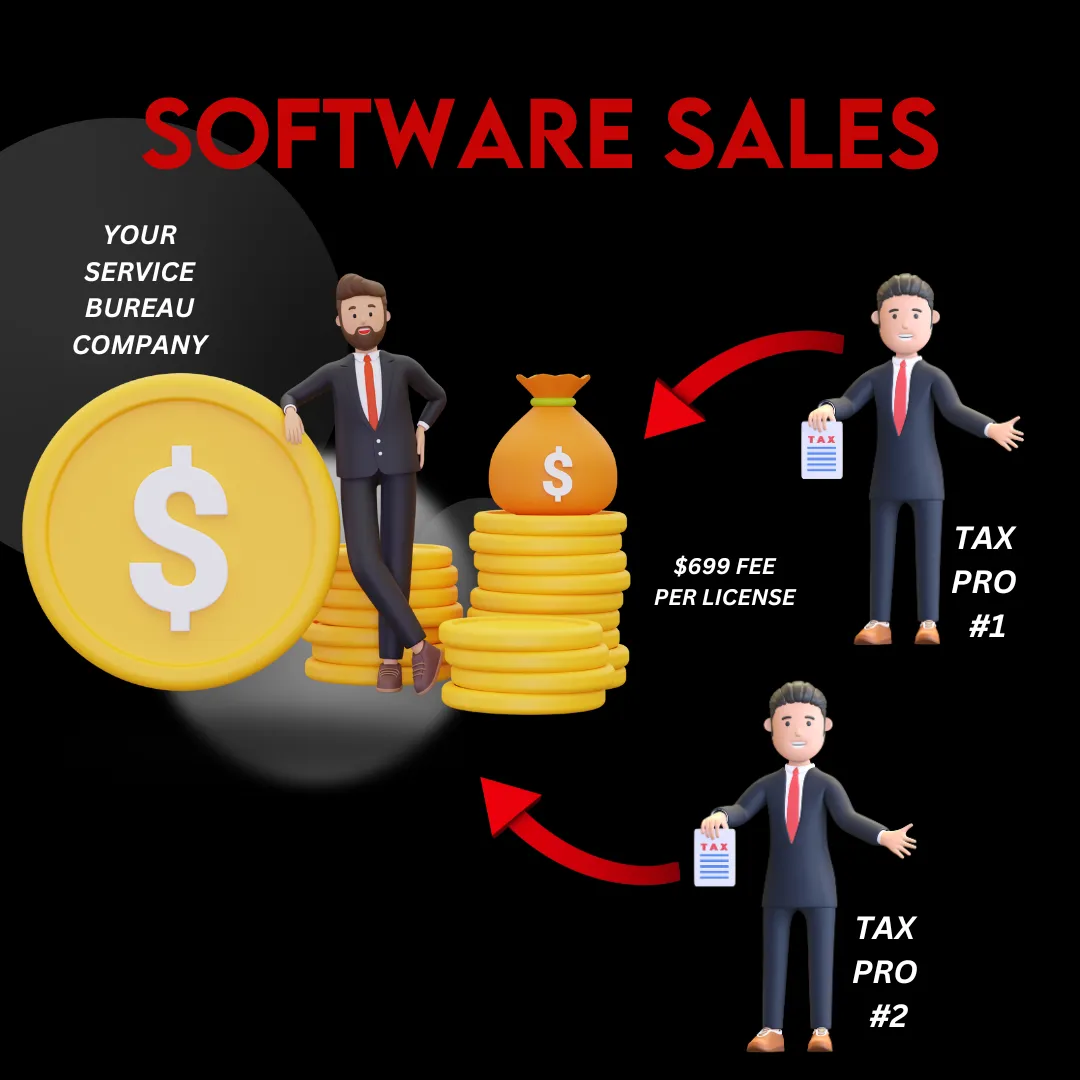

Revenue From Software Sales:

15 Software License @ $699

You earn $10,485

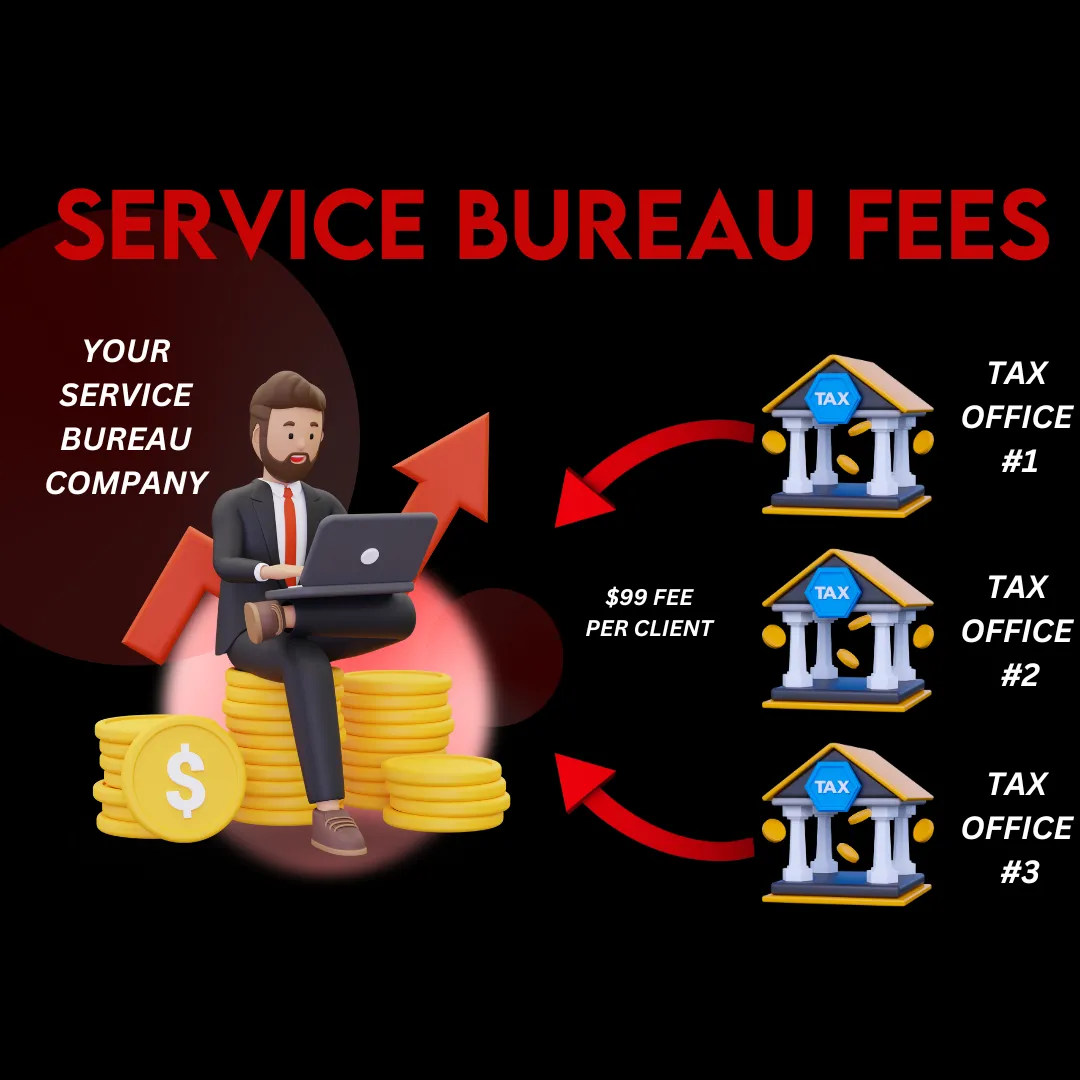

Revenue From Service Bureau Fees:

1,000 tax returns prepared under your bureau

@ $99/per client

You earn $99,000

Revenue From Software Sales:

1,000 Tax Returns @ $500 average

$500,000 x 30% revenue share

You earn $150,000

SEE IF YOU'RE ELIGIBLE

BECOME A SERVICE BUREAU TODAY

Innovate

Fresh, creative solutions.

Optimize

Streamline and enhance.

eMerge

Top-notch services.

FOLLOW US

COMPANY

CUSTOMER CARE

LEGAL

Copyright 2024. eMerge Tax Pro Partners. All Rights Reserved.

Created By. The Ultimate Entrepreneur